nc estimated tax payment calculator

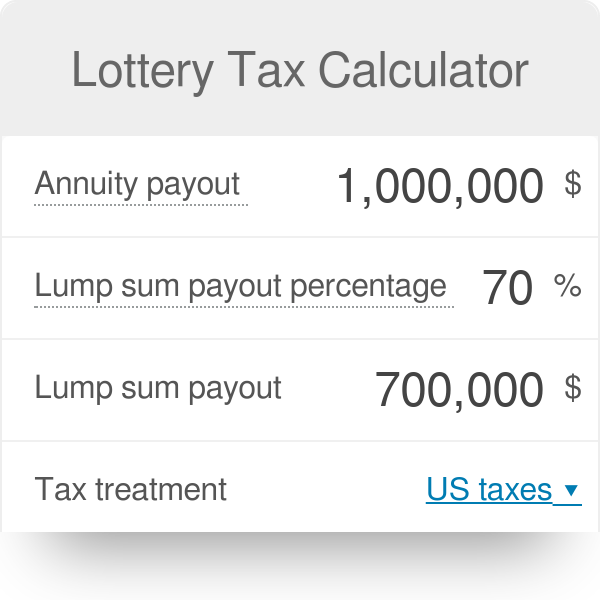

20846834 521171 Stephanies quarterly tax. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

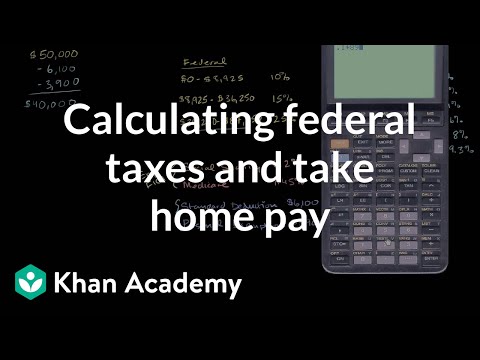

The IRS uses many factors to calculate the actual tax you may owe in any given year.

. Secondly youve learned that the state you live in can have an impact on your estimated liability rate. This Tax Withholding Estimator works for most taxpayers. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before April 15 June 15 September 15 and January 15 of the following year. Individual Income Tax Sales and Use Tax Withholding Tax.

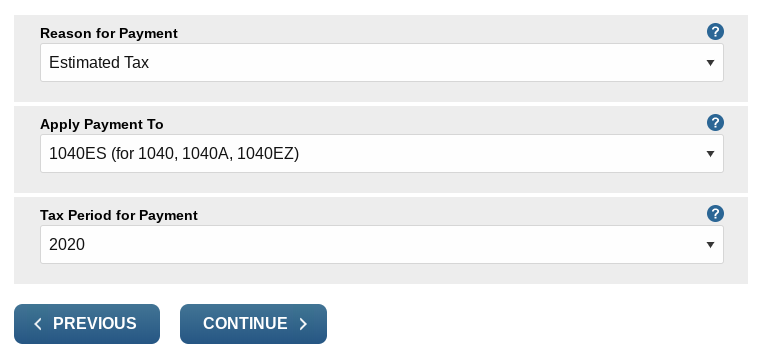

Now you know more about small business taxes than the vast majority of their owners. Once youve used our estimated tax calculator to figure out how much you owe making the payment is fairly straightforward and takes less than 15 minutes. Nc estimated tax payment calculator Friday March 4 2022 Edit.

North Carolina Department of Revenue. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments. Which bracket you land in depends on your filing.

Percent of income to taxes 34. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes. Note that if you are self-employed this calculator does not include estimated self-employment tax.

North Carolina Salary Tax Calculator for the Tax Year 202122 You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122. Created with Highcharts 607. File Pay Taxes Forms Taxes Forms.

NC Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0630. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Generally you must make your first estimated income tax payment by April 15.

Total Estimated Tax Burden 25676. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. 813024 1271659 2084683 Stephanies total estimated taxes.

The provided calculations do not constitute financial tax or legal advice. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate data to the user. Almost all employers automatically withhold taxes from their employees paychecks independent contractors and self-employed individuals need to submit quarterly or yearly tax payments independently as it is mandatory by law.

People with more complex tax situations should use the instructions in Publication 505 Tax Withholding and Estimated Tax. Please do not send cash. Click here for help if the form does not appear after you click create form.

Ad Enter Your Tax Information. NC-40 Individual Estimated Income Tax. This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long-term capital gains or qualified dividends.

6 Enter your social security number on your check or money order. When the due date for the estimated income tax payment falls on a. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and.

7 Mail the completed estimated income tax form NC-40 with your. Overview of North Carolina Taxes. PO Box 25000 Raleigh NC 27640-0640.

Please consult IRSgov Form 1040-ES for specific information about estimated tax for the self-employed. See How Easy It Is. This can make filing state taxes in the state relatively simple as even if your.

See What Credits and Deductions Apply to You. Most of the lottery winners want a lump sum payment immediately. Now the final step.

This calculator is designed to estimate the county vehicle property tax for your vehicle. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes.

How to calculate estimated taxes and make a payment. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Youve learned why Self-Employment tax is estimated to be larger than your LLC income tax in the tax 1099 calculator.

7 Mail the completed estimated income tax form NC-40 with your payment to. Your household income location filing status and number of personal exemptions. 156355 plus 37 of the amount over 523600.

You can also pay your estimated tax online. Federal and state tax for lottery winnings on lump sum payment in USA. To find an estimated amount on a tax return instead please use our Income Tax Calculator.

Your county vehicle property tax due may be higher or lower depending on other factors. April 15th payment 1 June 15th payment 2. To calculate her estimated quarterly tax payments for each quarter Stephanie simply adds together her income tax and her self-employment tax for the year and divides this number by four.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Recommends that taxpayers consult with a tax professional. IRS Tax Tables and Tax Rate Schedules and Forms.

Youll need to make the payments four times per year according to these due dates. The calculator should not be used to determine your actual tax bill. 46385 plus 35 of the amount over 209400.

Please enter the following information to view an estimated property tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes

Property Tax How To Calculate Local Considerations

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Calculator Tools Mortgage Amortization Calculator

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Quarterly Tax Calculator Calculate Estimated Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Paycheck Calculator Take Home Pay Calculator

Income Tax Calculator 2021 2022 Estimate Return Refund

Rateplug Is Helping Homebuyers Understand Home Affordability By Integrating Real Time Loan Payment Data Int Mortgage Marketing Mortgage Payoff Mortgage Brokers

Express990forms Express990forms Twitter In 2021 Solutions

North Carolina Income Tax Calculator Smartasset

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Solar Calculator Solar Panels Calculator Solar Energy Payback Calculator Solar Panel Calculator Solar Energy System Solar Calculator