franklin county ohio sales tax on cars

Has impacted many state nexus laws and sales tax collection requirements. The minimum combined 2022 sales tax rate for franklin county ohio is.

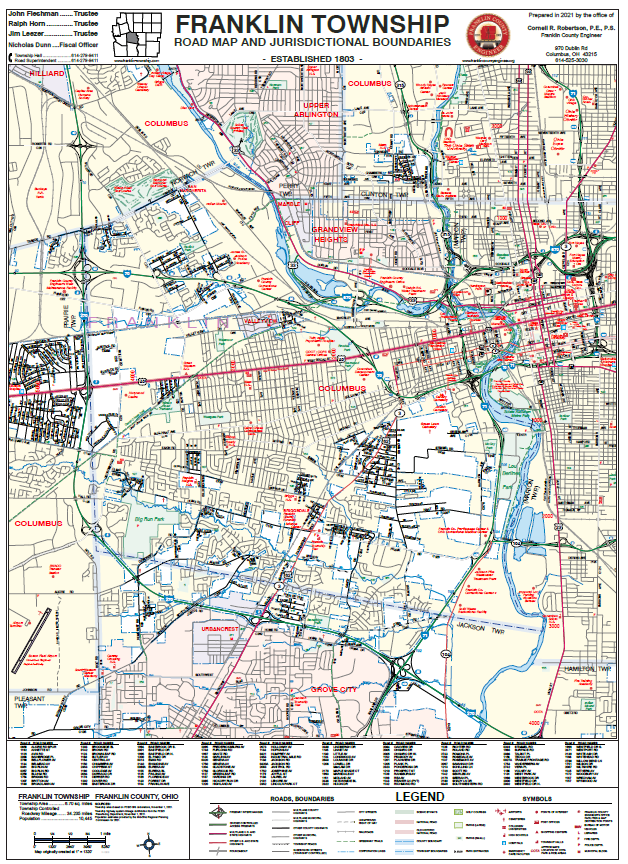

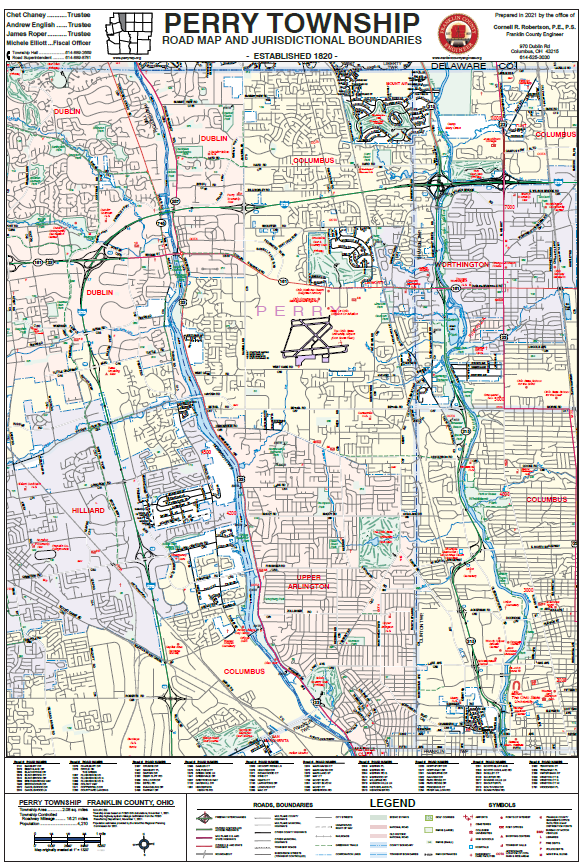

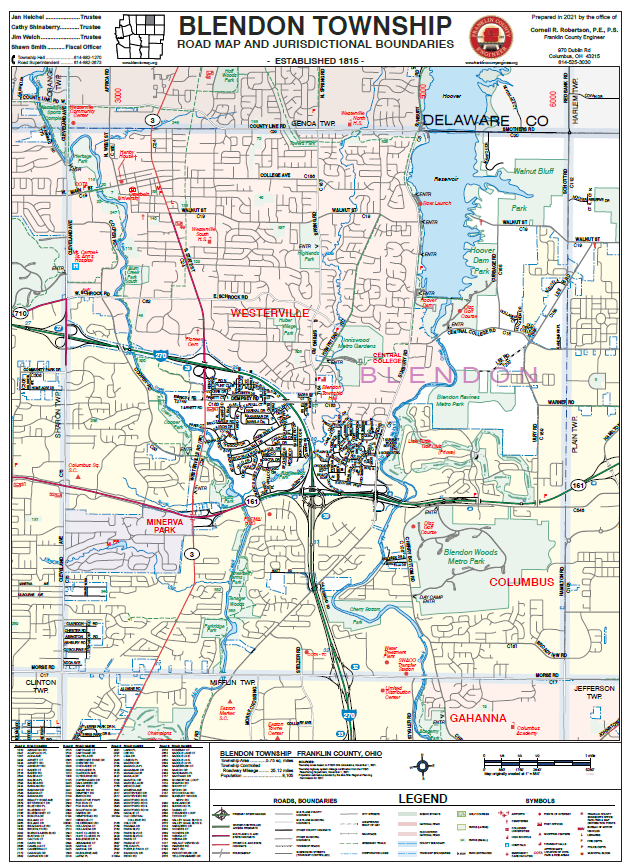

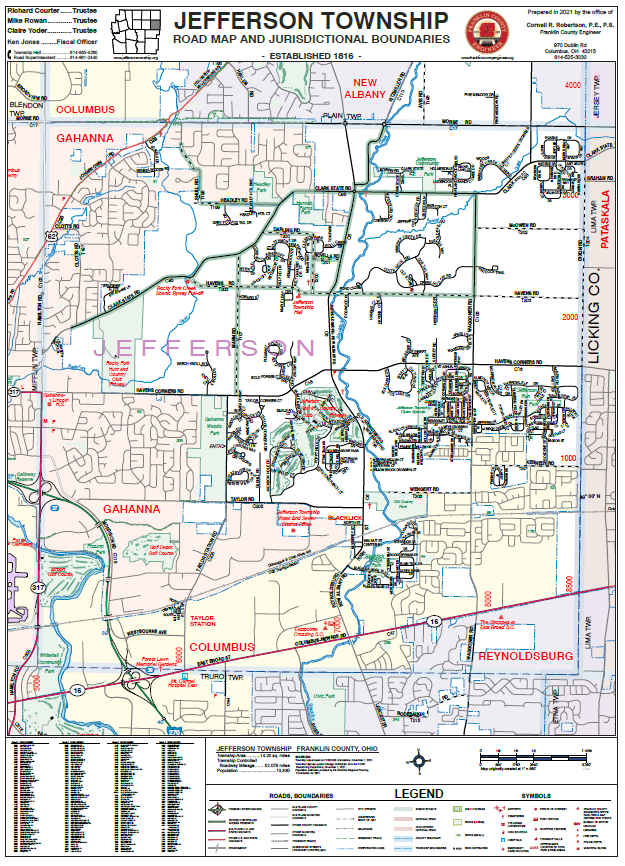

Township Maps Franklin County Engineer S Office

There are also county taxes that can be as high as 2.

. For questions about Sales Tax you should contact the City Finance Department at 256 427-5080 or FinanceTaxhuntsvillealgov. The office is located in the Franklin County Court House Annex at 1221 Hull Avenue Carnesville Georgia 30521. John Smith Street Address Ex.

Automating sales tax compliance can help your business keep compliant with. Sales tax is required to be paid when you purchase a motor vehicle or watercraft. The Ohio state sales tax rate is currently.

Your tax rate depends on your county of residence. Franklin Countys is 75. 17TH FLOOR COLUMBUS OH 43215-6306.

Franklin County Ohio. According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio. The County sales tax rate is 125.

According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio. The purpose of the annual Tax Lien Sale is to collect the delinquent real estate taxes owed to Franklin County school districts agencies and local governments. The Franklin sales tax rate is 0.

Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. According to the sales tax handbook you pay a minimum of 575 percent sales tax. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

Tyler Lowry Franklin County Commissioners 614525-6630 Jodi. 1500 title fee plus sales tax on purchase price. The combined sales tax rate for Franklin County OH is 75.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Be sure to look up your county tax rate on the Ohio Department of Taxation website. May 11 2020 TAX.

In addition to taxes car purchases in Ohio may be subject to other fees like registration title and plate fees. The County assumes no responsibility for errors. For example if you are purchasing a Ford.

We accept cash check or credit card payments with a 3 fee. The December 2020 total local sales tax rate was also 7500. Franklin county ohio sales tax rate 2022 up to 75.

All persons or businesses that sell tangible personal property at retail must collect tax and make payments to the City. You need to pay taxes to the county after you purchase your vehicle and. Some cities and local governments in Franklin County collect additional local.

Overview of the Sale. The Franklin County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

The 2018 United States Supreme Court decision in South Dakota v. All title transfers and exemption claims on motor vehicles and other equipment is regularly audited by the Ohio Department of Taxation in accordance with Ohio Revised Code RC 450509 B 2 c and 573913 to verify if. Some dealerships may also charge a 199 dollar documentary service fee.

The Franklin County Sales Tax is 125. Our office hours are Monday Friday 800 am. The Ohio sales tax rate is currently 575.

123 Main Parcel ID Ex. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. It is unlawful for the seller to keep any portion of sales tax collected from customers.

I live in Franklin county so from what I understand the tax on a new vehicle purchase is 75 55 for state and 2 for the county. There also is a 05 percent. Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725.

Franklin County Sales Tax Revenue Bonds Earn Unprecedented Dual Triple-A Ratings Thursday May 10 2018 Contact. The 2018 United States Supreme Court decision in South Dakota v. Did South Dakota v.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates. Our office is open Monday through Friday 800 am. The telephone number for the tag office is 706 384-3455.

Franklin County Ohio Sales Tax On Cars. Wayfair Inc affect Ohio. Franklin County Clerk of Courts.

The minimum combined 2022 sales tax rate for franklin county ohio is. You may obtain county sales tax rates through the External link Ohio Department of Taxation. Add 100 fee per notarization andor 150 for out-of- state transfers.

Search for a Property Search by. Please make checks payable to. Simply multiply the sum of the figures from Steps 1 and 2 by your local tax rate.

A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. Franklin county ohio sales tax on cars Friday March 18 2022 Edit. To review the rules in Ohio visit our state-by-state guide.

Press J to jump to the feed. 1956 Chevrolet Two Ten Police Car Highway Patrol Police Cars Old Police Cars Classic Cars Trucks Motorists Urged To Clean Snow Ice Off Of Vehicles Eagle Country 99 3. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance for which you may be entitled.

How much will my taxes be. But what is the. Has impacted many state nexus laws and sales tax collection requirements.

With the cash selling price and documentation fees added together it is time to calculate your sales tax.

Venues Summit County Summit County Ohio Map Ohio

County Bills Sent Out Christmas Week Here S A 10 Point Primer

Franklin County Raising Plate Fees

Franklin County Treasurer Home

Step By Step Guide To The Franklin County Probate Process Columbus Real Estate

Demographics Franklin County Ohio

Demographics Franklin County Ohio

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Franklin County Auditor Licensing Types

Demographics Franklin County Ohio

Franklin County Treasurer Home

Franklin County Auditor Personal Property Tax

Auto Title Manual Franklin County Ohio

Franklin County Treasurer Home

Franklin Township Police Department Facebook

Services Franklin County Engineer S Office